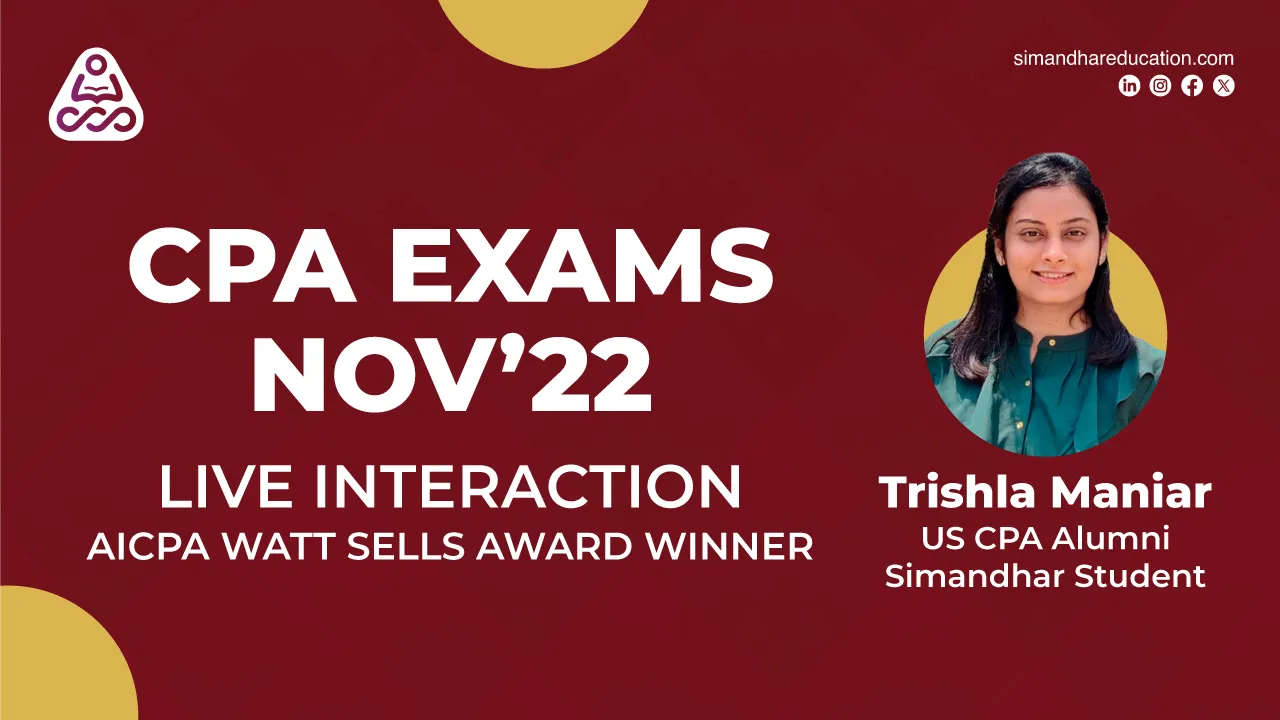

Simandhar CPA Student does it again |CPA Watt Sells Winner | Trishla | CPA Course

+copy.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

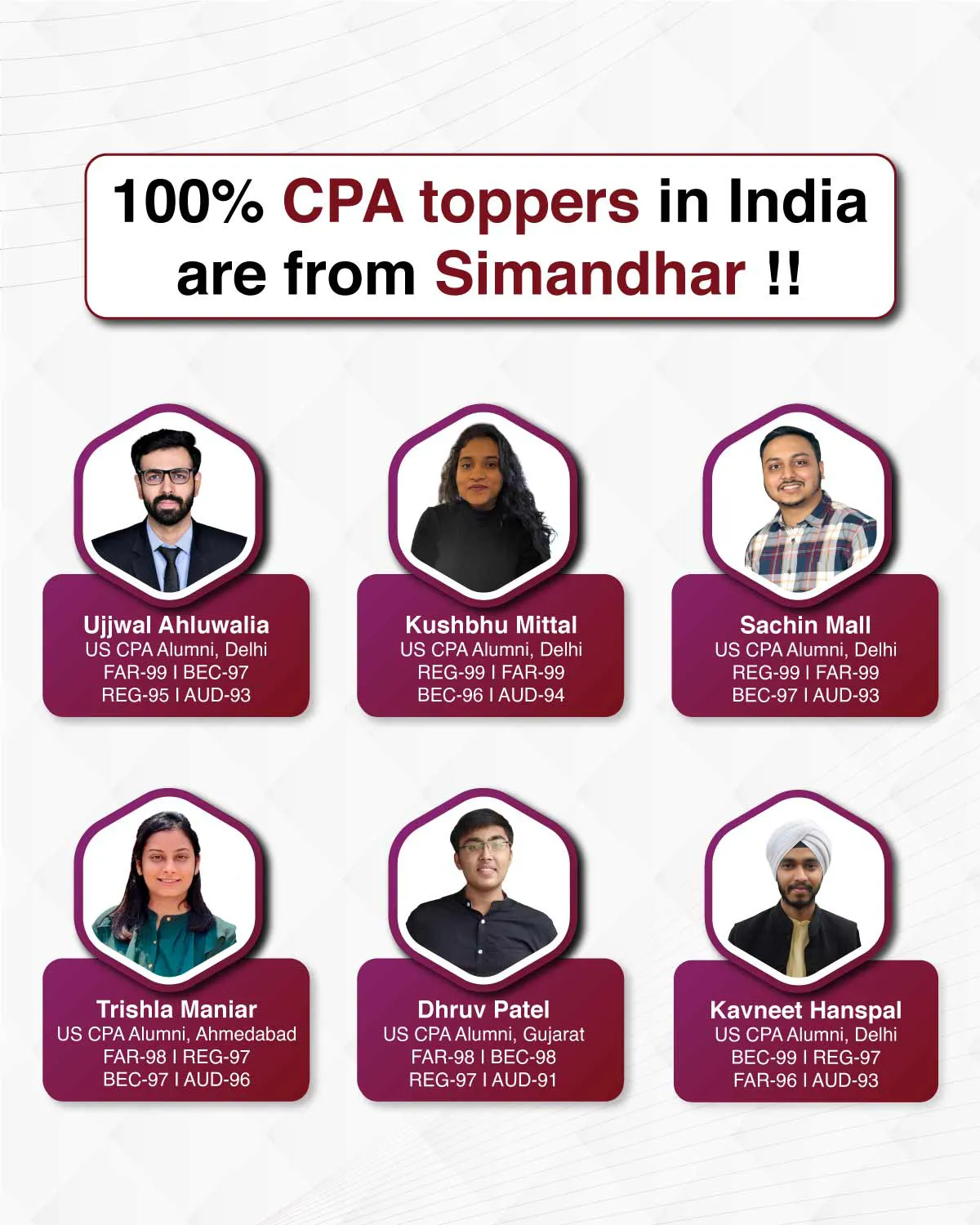

Launch your global accounting career with India's most trusted CPA training provider.

Simandhar Education, the Exclusive Partner of Becker in India, combines Becker's world-renowned CPA content with expert Indian faculty, 24×7 support, and top-tier placement opportunities - giving you everything you need to crack the US CPA exam and thrive in a global finance career.

Launch your global accounting career with India's most trusted CPA training provider.

Simandhar Education, the Exclusive Partner of Becker in India, combines Becker's world-renowned CPA content with expert Indian faculty, 24×7 support, and top-tier placement opportunities - giving you everything you need to crack the US CPA exam and thrive in a global finance career.

One of India’s most recognized US CPA faculty, mentoring thousands of finance professionals.

The only Indian to be featured twice among USA’s Top 40 Young Accounting Professionals by CPA Practice Advisor & AICPA.

Leading India’s premium institute for US CPA, US CMA & EA courses, with collaborations across Big 4, corporates, and global universities.

70K+ LinkedIn community | Guest speaker at AICPA Engage & IIMs | Advisory Board Member at top 4 CPA firms | Author of The Unique Classroom.

Featured in The Times of India, The Indian Express, The Financial Express, News18, and many more.

Check Here

AUD — Auditing and Attestation

FAR — Financial Accounting and Reporting

REG — Taxation and Regulation exam

TCP — Tax Compliance and Planning

ISC — Information Systems and Controls

BAR — Business Analysis & Reporting

Our founder had the privilege of representing India at a special lunch hosted by NASBA, where key discussions were held around the challenges faced by Indian students regarding CPA eligibility and evaluation. This conversation helped highlight the unique needs of Indian professionals, and as a result, we are now offering end-to-end evaluation, licensing, and eligibility services to better support those navigating the CPA process.

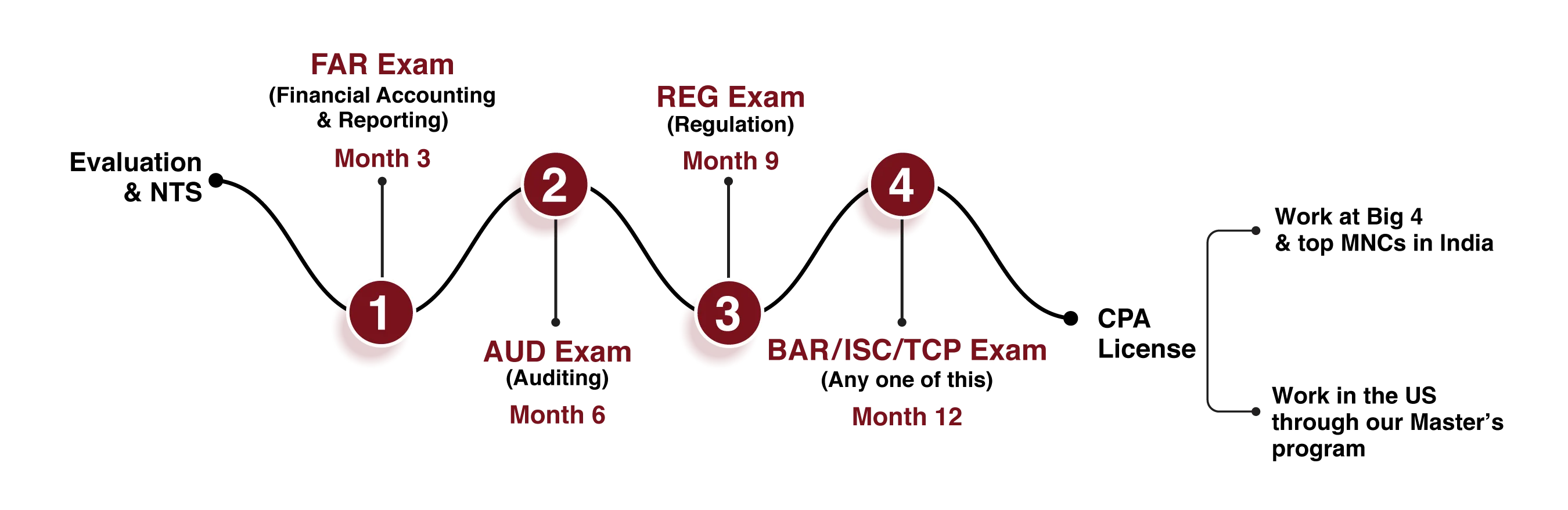

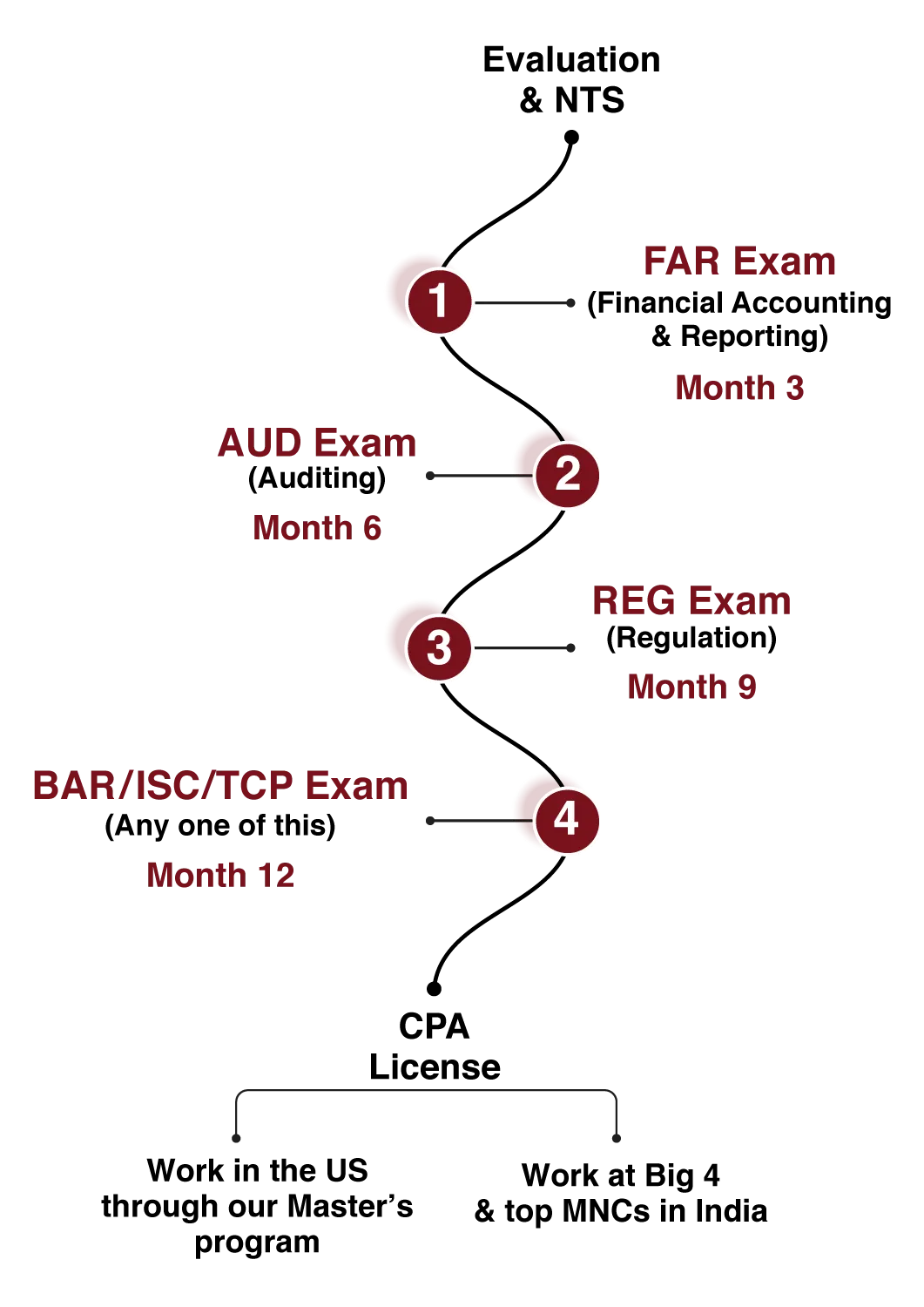

You must complete 120 Credits with a bachelor's degree + 2yrs of work experience approved by NASBA.

Leverage Simandhar’s exclusive job portal & Big 4 tie-ups to land your dream job.

Gain a globally recognized CPA credential and expand your career opportunities.

Work as a Senior Auditor, Tax Consultant, CFO, or Forensic Accountant.

SIMANDHAR CPA Course vs Others

SIMANDHAR CPA Course vs Others*Note: For Indian students in the USA, the price will be INR 2,25,000 (2,499 USD) for 2 years of access. USD prices are subject to change.

*To request for fees without Immersion, enquire here

Real stories from learners who transformed their career

Real stories from learners who transformed their career

+copy.webp)

.webp)

+copy.webp)

+copy.webp)

+copy.webp)

+copy.webp)

.webp)

+copy.webp)

+copy.webp)

+copy.webp)

Visit your nearest Simandhar Education office to explore opportunities, get career guidance, and take the next step towards your global finance career.

All US CPA evaluation and licensing requirements are governed by respective State Board policies. Any changes in statehood rules or regulations are solely under the authority of the State Boards/NASBA, and Simandhar Education holds no control over such policy updates.