Best CPA/CMA Coaching Institute in India

Visit your nearest Simandhar Education office to explore opportunities, get career guidance, and take the next step towards your global finance career.

+copy.webp)

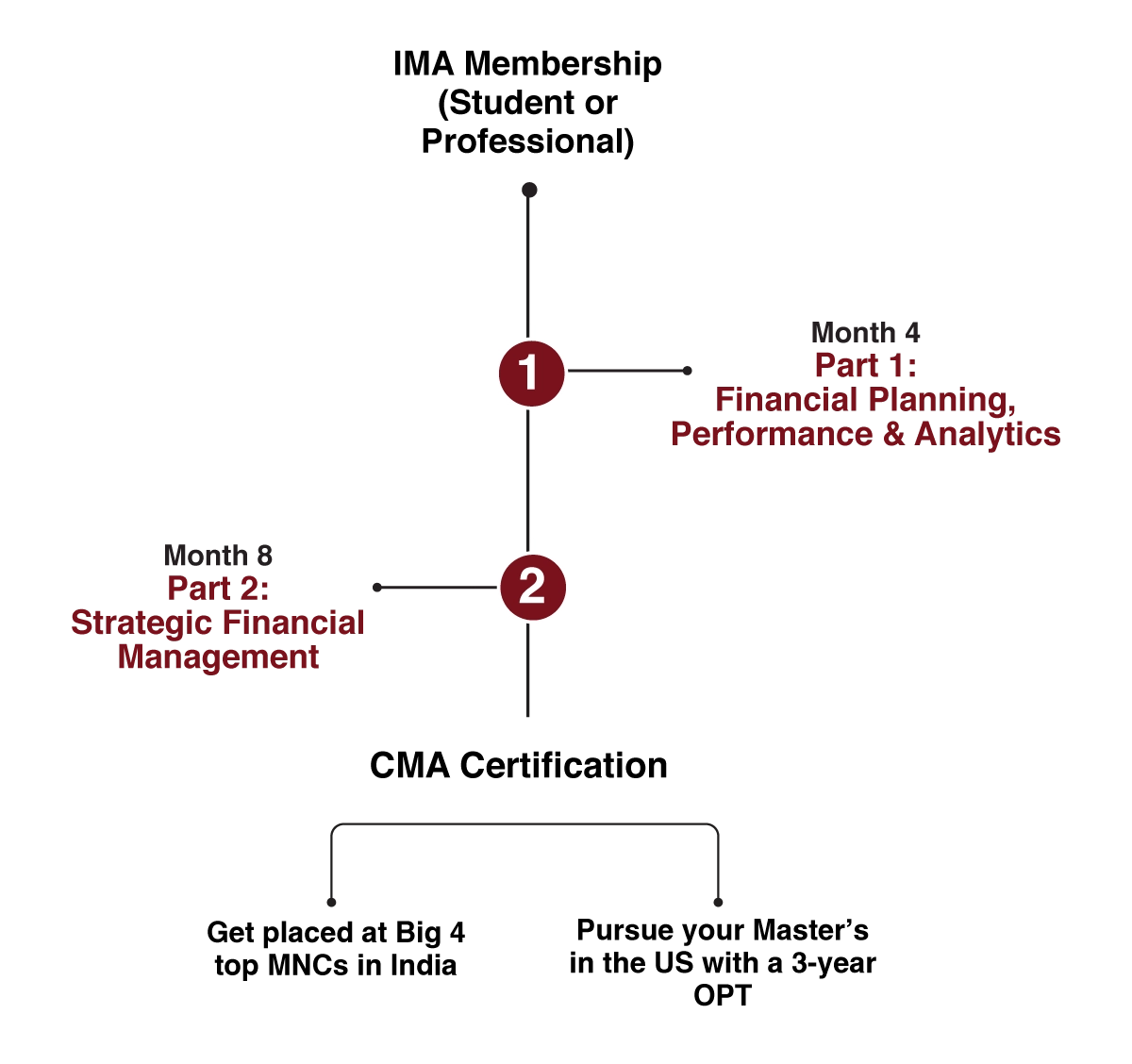

Jobs at Big 4 & MNCs in India · Route to work in the US

Meet AI Sripal – Your 24/7 Global Finance Mentor↗

Jobs at Big 4 & MNCs in India · Route to work in the US

Accelerate your US CMA journey with India's most trusted training provider and Becker's exclusive partner.

Simandhar Education, an IMA Platinum Learning Partner, offers the perfect blend of globally recognized Becker content and India's best-in-class mentorship, smart tools, and career support.

Register & access Simandhar’s AI-driven LMS and Becker study materials.

Gain a globally recognized US CMA credential and expand your career opportunities.

Leverage Simandhar’s exclusive job portal & Big 4 tie-ups to land your dream job.

Start your career as a Financial Analyst, Risk Manager, CFO, or Tax Consultant.

.webp)

Simandhar US CMA Course vs Others

Simandhar US CMA Course vs Others*To request for fees without Immersion, enquire here

Apart from the US CMA course fees, candidates need reliable and comprehensive study material to prepare effectively for the exam. The cost of CMA study material generally depends on the format you choose—digital or printed—and whether you opt for self-study or guided coaching. On average, this cost can range between $600 and $2,000.

Simandhar Education provides expert-curated CMA study material along with structured coaching, mentor support, and exam-focused preparation. For aspirants who prefer guided learning with continuous academic support, Simandhar's CMA program is a valuable long-term career investment.

Real stories from learners who transformed their career

+copy.webp)

.webp)

+copy.webp)

+copy.webp)

+copy.webp)

+copy.webp)

.webp)

+copy.webp)

+copy.webp)

+copy.webp)

Visit your nearest Simandhar Education office to explore opportunities, get career guidance, and take the next step towards your global finance career.